The Inflation Debate

Data on US CPI were released last night. It was a year-on-year increase of 5.4 percent. It has been the highest for some time.

If you are watching or reading financial news, you would get the sense that the world is about to end, with the global economy heading into hyperinflation. Almost every pundit is saying this is bad, really bad.

I don’t know that. To me, as I have said in this blog before, high inflation is what Latin American countries, like Venezuela, go through. High inflation is in thousands of percent per year, and hyperinflation means thousands of percent per day. The current rate of inflation that every financial analyst in the US is commenting on is nothing like that.

Last month’s CPI was 5.1 percent and the month before that was 4.2 percent. Yes, for three months, it has been going up, but my sense is that the rate of increase is slowing down. 5.4 percent this month is a smaller increase than last month’s. Would I worry about it? Not really.

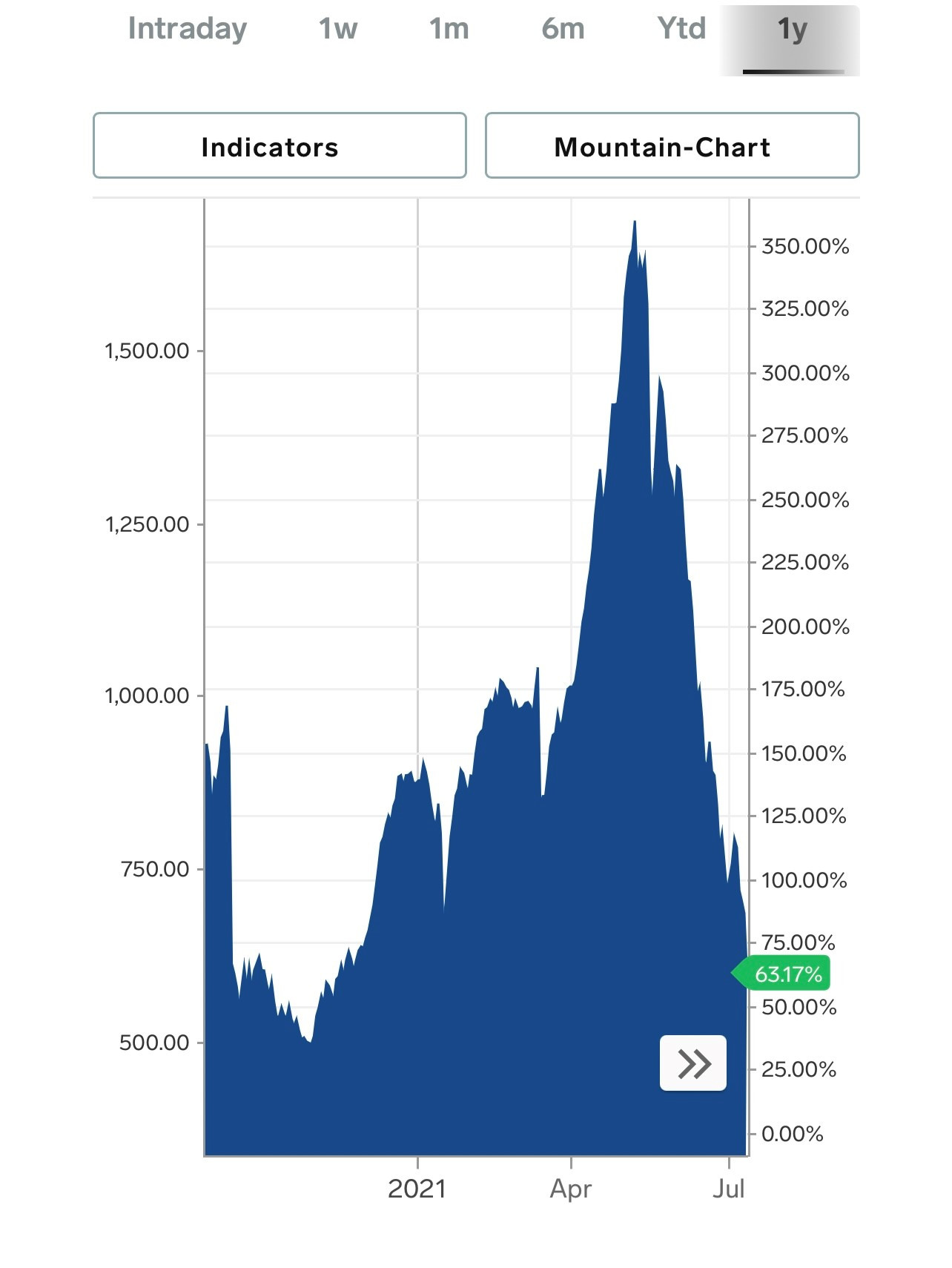

Especially since commodity prices, often cited as the reason for rising inflation in the last six months, have stopped rising or have actually turned around. In particular, lumber prices - the fastest rising commodity price until last month - crashed in recent days, and all its gains in 2021 have been completely erased.

Lumber prices, 2021

Gold, the so-called inflation hedge, has been sputtering for the last few months. And aha, bitcoin, the new “inflation hedge”, has continued to fall in both price and volume. It is now at about $32,000, half its value in April; and volume is off about 40 percent.

Hyperinflation? People who have to invest have not put money into what people regard as “inflation hedges”. In short, real decision makers, rather than talking heads and writers, don’t think there is serious inflation yet.

Other analysts keep harping on the fact that the CPI is not a good indicator of real inflation. They cite steeply rising asset prices as proof of “asset inflation”. But while it can be said that every participant in an economic system would not like high inflation as measured by the CPI, it is hard to argue that asset inflation is all bad. After all, under asset inflation, the stock of assets in the economy is increasing in value, and that has to be good. It is at best an argument on wealth inequality, as those who own assets, ie the rich, are pleased with asset inflation (ie they are getting wealthier) while the poor are getting priced out. That becomes a political problem, rather than an economic one.

The problem with inflation, often cited by economists, is that inflation causes savers to become worse off. Consumers on the other hand, will be encouraged to spend the money they have in hand, before their money loses value. This will reduce the savings rate in an economy and that is not a good thing because new productive investments to propel an economy forward depends on savings. China’s economy is where it is today because of a very high savings rate, at nearly 40 percent.

Have savers in America suffered? Well, it cannot happen because the savings rate in the US is close to zero. There are no savers… The savings rate cannot go lower. When liquidity is available, the savings habit is not there to absorb the money. Instead, speculation has shot up.

For investors who have to put their money where their mouth is in the US bond market, there is almost a perverse reaction to the often articulated view of rising inflation. As we now know, the benchmark 10 year US Treasury has recently gone from 1.6 percent to a low of about 1.3 percent last week, and it is now 1.35 percent. Bonds would always be ravaged by high inflation, but it looks like the investors who hold multiple trillions of bonds, are not bothered. This phenomenon of savvy investors holding on to bonds, to me, counts more in my analysis of inflation, than all the noisy chatter.

Of similar significance as the reaction of bond market to the inflation numbers is also how the US Dollar has performed. Even as the CPI data became known, the Dollar rose. Remember how all the doomsayers were saying throughout the last year until recently that money printing, leading to inflation, would crash the dollar? Well, the CPI is rising but FX markets are taking it all in stride, and the US Dollar is continuing to rise. It says that investors are not acting like media and investment writers are saying how events are unfolding. Is this surprising? Not at all. It is always more important to watch how the smart money moves. Reading/hearing popular financial commentaries produces abjectly incorrect conclusions. Journalists are not investors.

It is also noteworthy that the fear of inflation is not only premature but also misguided. After all, in the not-so-distant past, when Covid 19 was raging, there were loud cries to get the government (the Federal Reserve and the Treasury) to save the economy. Interest rates went to zero and trillions of public expenditures were budgeted and are now being spent in good old Keynesian fashion. With the vaccinations, which at one time were not known to be as effective as they have actually been since implementation, the economy in the US seems to be on the mend.

And even as that nascent recovery is just happening, all kinds of voices are calling for a change of direction in economic policy, citing imaginary “inflationary pressures”.

This flip flopping of opinions among investors (who are of course by definition a disparate bunch so that there are always buyers and sellers at any one time) has so far met with steadfast resolve at the Fed under Jay Powell and the Treasury under Janet Yellen to stick to the current course of action. That resolve has resulted in continuing near zero interest rates, deficit financing and what most critics call “money printing”, sometimes called the “new monetary economics”. The Fed is trying hard to defend the view that inflation is transitory and temporary. If the rise and fall of lumber prices are anything to go by, this is exactly what Powell is saying. High prices will pass. The initiative of policy is unchanged – get unemployment down to pre-pandemic levels. This is still some ways away.

At this point in the economic cycle, I am in the Fed’s camp. Worrying about inflation is premature. Why?

While there are signs that the US economy is indeed turning around, the easy monetary policies have to continue. With this on-going policy, real yields are negative, and market mechanisms and asset prices are being distorted, leading to unprecedented levels of investments in stocks, bonds, real estate, commodities, ESG projects and wildly volatile cryptocurrencies.

Is this easy money a policy response that will first save, and then subsequently destroy the US and the global economy? Is there an alternative but to inundate the economy with liquidity? Lower the flood gates to create a rising tide that lifts all boats, and then let the ensuing tide drown everything caught in it? That’s the concern of the worriers…

Actually, the Fed and the other major central banks have no other policy options unless they can become God and can predict exactly when recession turns into expansion.

One just has to go back to the history books which recorded the huge mistakes that were made during the Great Depression when the government stood by and did nothing as markets and the global economy imploded and ultimately led to the Second World War. They were still thinking Adam Smith laissez faire before Keynesian interventionist economics was born.

While the US government at that time did respond to the start of depression with some economic relief pressures, their unfamiliarity with modern economics, as the world left agrarian lifestyles to become industrial and urbanized, led to inaction. The result was deflation. With the 100 years between that disastrous government passivity and today, the lessons of Great Depression economic policy are clear. Deflation is a much worse condition than inflation.

There is no question that the Fed had to act strongly and without second guessing by economic participants during the pandemic recession of 2020, which was recognized as the worst disaster to happen to the world economy in a century, and to be of a magnitude likely to be greater than the 2008 Global Financial Crisis.

Today, in July 2021, while there are signs that the US economy and the rest of the world are beginning to bounce back to normalcy, it is still too early to say that deflation cannot happen. After all, public health experts are still concerned about the Covid Variant Delta, many countries are still in lockdown, and the financial remedies are at best halfway along its prescribed course. If suddenly terminated, would the recovery be aborted? The Fed is not taking any risk that it would.

I tend to agree with that. The lessons of the Great Depression are valuable, and that is the top priority – bring full employment back. Eliminate the possibility of deflation. So let’s not second guess the Fed.

It is nevertheless valid to line up post-recession lessons from recent history without having to go through another war like the one in 1937 to 1945.

These are of course the side effects and collateral damage of easy money. We have seen it all before, and there is a sense of déjà vu.

Just as the 21st Century was beginning twenty years ago, the Fed under Alan Greenspan cut rates aggressively to respond to the 1997 Asian Financial Crisis and the fallout from a hedge fund, Long-Term Capital Management, collapsing. The massive amount of money made available could have led to too much money chasing the sexy trade of the day – the dotcom phenomenon, and we saw Nasdaq rising like a tulip bubble with an inevitable follow-up crash. The current crypto currency craze looks exactly like that.

A blame game is being set up. Americans who have no idea what savings mean, are using all the extra money that has been given to them to rescue them from economic hardship to play with Robin Hood, meme stocks, cryptos and new-fangled ways of speculation. In another part of the world, in particular China, the response of citizenry to easy money has been to sock it all away, due to culturally high savings rates, which then comes around to drive up Chinese property prices by some 20 percent. But at least those are real assets which have a productive use. When the financial assets in the American economy crash, savings will still be zero, and the economy will enter another gut-wrenching phase of rescue operations.

While US stocks are at high levels, S&P stocks are trading about 22 times the coming year’s profits, which under “normal” market conditions trade at about 18 times. The gain in equities has been about 20-30 percent per year. Bonds are at 1.3-1.4 percent, and that is probably sustainable. Gold has not moved for nearly one year, and the only outlier to a flush monetary system seems to be where there is about 1 to 1.5 trillion dollars of play money in crypto currencies. If I have to guess where the next financial crisis will start, I would go no further than the mess being created by the influencers in that industry, who while bashing the Fed for printing too much money are in the same breath pushing and pumping crypto currencies which have no intrinsic value to higher and higher levels.

I watched an Youtube video with amusement about a couple who recently went to El Salvador to see if the legal tender of bitcoin, scheduled to start in a month or two, works. They found that the restaurant they visited don’t want to accept their bitcoin, which they changed from one of two ATMs in the country at a cost of US$7 for a conversion of US$20 from dollars to bitcoin. That’s a 33 percent (not 3 percent) commission! I call that rape and ravage. It is going to topple the El Salvadorean president, who thought up this stupid idea of using bitcoin as legal tender.

This sector of speculation in crypto has already lost half its value in about 2 months, and there is another trillion dollars to be lost. That is not small change. If it is indeed lost in the coming months, who do you think the losers will blame?

In the absence of serious inflation (which I define as double digit changes in price levels), why can’t people with spare change just learn to save, instead of speculating it all away? And then always looking for government to blame??? The problems they think they face actually lie within their own behavioural characteristics…

Wai Cheong

Investment Committee

The writer has been in financial services for more than forty years. He graduated with First Class Honours in Economics and Statistics, winning a prize in 1976 for being top student for the whole university in his year. He also holds an MBA with Honors from the University of Chicago. He is a Chartered Financial Analyst.